The role of alternative assets in a

balanced portfolio

Alternative assets have come under more scrutiny in recent years, as clients look for more diverse ways to generate returns.

What used to be considered niche asset classes, have now gained more respectability, and moved further into the mainstream, as clients start to appreciate their utility.

But how do they perform, and what are the risks? Are they true diversifiers away from tradition equities and bonds?

This feature aims to look at some of those issues.

Majority of advisers see role for alternative assets in portfolios

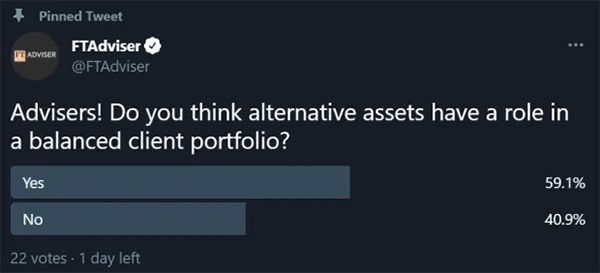

The typical balanced, or middle-risk client portfolio should contain some alternative assets, according to the majority of advisers who responded to the latest FTAdviser survey.

The survey, which was conducted via the FTAdviser Twitter account, found that 59 per cent of respondents view alternative assets as having a role in a balanced portfolio, while 41 per cent disagreed.

Government bonds trading at very high valuations at the same time as many equity markets are trading at close to record levels has created the problem of diversification for advisers and clients.

Alternative assets covers a wide range of potential investments, from alternative income products, such as music royalty investment trusts and infrastructure funds – which are predominantly viewed as alternative sources of income and as a potential replacement for bonds – to hedge fund strategies and absolute return funds, which aim to deliver returns that are not correlated with the performance of the wider market or economy.

A subset of these types of funds are long/short equity strategies, which attempt to own the shares that they think will go up, but also have short positions on shares they think will fall. Such strategies will generally aim to perform better than a standard equity fund in times of market stress.

The final category of alternative assets, such as gold and other commodities, tend to perform well in times of sharply rising inflation.

The aftermath of the global financial crisis has brought a fresh suite of challenges for asset allocators, as the traditional correlations between bonds and equities broke down, yet the traditional client priorities of reliable income and portfolio diversification remain as vital as ever.

Central bank policies in the aftermath of the global financial crisis caused both equities and bonds to rise in value, almost in defiance of wider economic conditions, whereas traditional market theory states that government bonds and most equities should move in opposite directions, as determined by the wider economic conditions of the day.

Attempts to square this circle have resulted in a rise in interest in alternative assets, with products offering exposure to everything from music royalties and aircraft leasing, to investment trusts that invest in private equity funds, and absolute return funds. They market themselves as being capable of delivering returns in all market conditions, finding various periods of favour with investors over the past decade.

The challenge is summed up by James Penny, UK chief investment officer at TAM Asset Management, who says: “Multi-asset managers like myself are having to search that much harder to provide that all important diversification tilt which can protect as well as enhance a client’s wealth.

"With the advent of tech innovation and global interconnectivity, markets holistically are that much more efficient at evaluating opportunities and thus deriving a price from them almost instantly. Combine that with unprecedented state intervention of QE and it is no surprise bonds and equities have started to become more correlated as trillions upon trillions has been thrust into every corner of the market.”

Real assets, and alternative assets, have an increasingly important role to play within a diversified portfolio

He adds: “In many respects alternative assets such as private equity, SPACs, property, precious metals and thematics, to name a few, remain more nuanced in their appearance and can thus still retain an element of market inefficiency around them which can throw up opportunities for investors.

"The key to the way they achieve this is in the name 'alternatives'. Core portfolio management uses equities and bonds together in a combination that yields the best results in line with a client’s appetite for risk. So an alternative asset, loosely speaking, falls outside of these traditional markets, and behaves in a way that makes the assets invested into it move differently to both the equity and bond market.

James Sullivan, head of partnerships at Tyndall Investment Management, says: “The term ‘alternative assets’ is wide ranging, and one could go as far as suggesting it covers anything that falls outside the conventional equity or bond universe.

"Real assets, and alternative assets, have an increasingly important role to play within a diversified portfolio. It's a genre of investing that has gained greater traction as bond yields became almost un-investable, trading far below a real return and in many cases, even a nominal return. This has proved to be fertile ground for what feels like perpetual new issuance of alternative funds.”

Narrow it down

Phil Waller, an asset allocator within the alternative investments team at JP Morgan Asset Management, says the first thing to do when discussing alternative investments with a client is to understand what they are looking for.

He says: “Alternatives is such a broad term, the first thing to understand is what they are trying to achieve. I think the thing to do then is divide the universe of alternative assets into those which aim to provide the bulk of returns from capital gains, and those which derive the bulk of their returns from an income payment. The former are like equities, while the latter are more akin to bonds.”

Waller adds that the next step is to divide the equity-like assets into “return enhancer”, which is one aspect to add to the portfolio, and those assets which are there to offer downside protection.

Alternatives can be broadly divided into four categories:

- Alternative income products, which are effectively replacing bonds in portfolios;

- Macro or hedge fund type strategies that aim to reduce overall volatility in portfolios, similar to the role bonds used to play;

- Real assets, which includes infrastructure and perhaps listed private equity; and

- Commodities such as gold, which are in portfolios as a hedge against inflation.

Charles Hovenden, portfolio manager at Square Mile, says many of the above mentioned products are replacements for something else in a portfolio, but they are not diversifiers as a client is essentially trading some of the diversification benefits for greater liquidity.

Hugo Thompson, an associate in the multi-asset team at HSBC Asset Management, says assets that offer less liquidity tend to trade at a lower valuation, so allocating to alternatives offers the chance for clients to gain exposure to this illiquidity premium.

Alternatives is such a broad term, the first thing to understand is what they are trying to achieve

Hovenden says: “Take the example of music royalties, now if you own the rights to a song by Madonna or someone, that is definitely diversified, there is no link between the performance of that asset and the wider economy. But the problem is, what investors are offered is, investment trusts which invest in the royalties, and investment trusts are listed on equity markets, so the actual exposure a client gets is to an equity instrument, which is fine, and those assets have performed very well, but the client should not expect them to perform differently to the wider equity markets.

"They pay a return that is attractive relative to bonds, and may be an alternative to bonds in that way, but the client is taking on equity risk. Because they are listed, they are more liquid, but that means you get less diversification.”

Hovenden says much the same applies to assets such as infrastructure funds. While the underlying asset has an income stream that is diversified, the way advised clients can get exposure is via a listed equity fund, which carries equity market risk.

Simon Elliott, investment trust analyst at Winterflood, says one issue with investing in the music royalty trusts is that the number of attractive assets, that is, the number of artists with proven long-term hits, is declining, so each time new capital is raised, the risk is the quality of the song catalogue is lower quality, changing the risk profile of the asset.

Tyndall's Sullivan says: “However, that is not to say alternatives are a pari passu replacement for bonds. Far from it. They carry different characteristics, both risk and return, so should be judged both on their own merits and what complementary factors they bring to a portfolio. The doomsayers among us would argue the infancy of this investment opportunity carries a greater degree of risk than we are able to factor in.

"One often finds that although the cash flows from real assets are arguably more stable, which does lend itself to bond-like comparisons, when we witness a risk-off event in markets, correlation to equities goes to one and they exhibit great volatility. So one must try and look beyond that and focus on the longer term correlations to understand how best to position them within a portfolio."

Hovenden is also wary of investing in absolute return funds. He says such products tend to have a substantial exposure to equities, and so do not offer protection in a market sell-off, while underperforming wider equity markets in a bull market.

Sullivan says the returns from assets such as hedge funds are generally more diversified, as they should not perform as well in booming equity markets, but offer greater protection in down markets, while the returns from alternative income investment trusts tend to have their direction set by the direction of wider equity markets.

Alternatives are a pari passu replacement for bonds. Far from it. They carry different characteristics, both risk and return

Hovenden is skeptical of the investment case for most absolute return funds that seek to take a macroeconomic view on the economy, but is keener on long/short equity funds, where a fund manager can invest in the prospects of a share price falling. He says this is one of the areas where genuine diversification can be achieved.

Tony Stenning, chief executive at Atlantic House, says one of the assets one can use to achieve genuine diversification is volatility, known as Vix; it is an investment that rises when volatility increases.

Steven Tredget, who works on the Oakley Capital investment trust, a private equity trust that invests in the shares of private companies, says his area offers diversification because the companies it buys are not listed on mainstream equity markets.

Real assets

A notable feature of the asset management industry lately has been the increased focus on what are called real assets, with both Schroders and Abrdn announcing the appointment of a head of real assets.

Real assets tend to include physical assets such as real estate and infrastructure.

Luke Hyde-Smith, head of fund selection at Waverton, says: “Our contention is that an allocation to real assets can help investors meet the challenge of the low interest rate environment and bring portfolio diversification benefits.

"We believe that real assets deserve to be considered as a core allocation within investment portfolios over the long term. The asset class has proven its value over time by providing reliable long-term total returns, inflation protection and the ability to offset the volatility of equity and fixed income investments.”

David Jane, who runs a range of multi-asset funds at Premier Miton, says: “We think real assets have always been important in mixed asset portfolios for the obvious reason they provide diversification and protection against inflation.

"Real assets could be regarded as anything that is tangible such as property; asset-based equities, such as mining or materials; or gold and other commodities. In some ways, real assets can be regarded as lower risk, their value is more ‘known’ as compared to growth equities whose value is dependent on assumptions around the future."

However, he adds: "They shouldn’t be regarded as a full substitution for bonds as their return is still dependent on expectations of the future, whereas bond returns are known at the point of purchase so long as they don’t default.

"The main attraction of real assets is protection from inflation, which bonds do not offer and given the relative uncertainty of the inflation outlook at present, we are holding relatively high weights in gold, property and hard asset equities."